Public Works is UNISON Scotland's campaign for jobs, services, fair taxation and the Living Wage. This blog will provide news and analysis on the delivery of public services in Scotland. We welcome comments and if you would like to contribute to this blog, please contact Kay Sillars k.sillars@unison.co.uk - For other information on what's happening in UNISON Scotland please visit our website.

Friday 3 July 2020

Housing and the Pandemic

Social housing is an essential service. But you’ll find little mention of its role during the pandemic outside of the world of housing professionals.

Yet the benefits – the ‘social good’ - of publicly owned and run housing (i.e. council housing) and social housing (i.e. housing associations or RSLs, and housing cooperatives1) have shone through during this covid-crisis. Social landlords have played an outstanding role above and beyond in caring for the most vulnerable people, including those who are shielding with health conditions.

Take North Lanarkshire Council. It has the largest council housing stock in Scotland and provides homes to over 36,000 households. At the point of lockdown, on 23 March, a third of these households were shielding. Council staff proactively phoned them all. Overnight they set up a system, working shifts from 8am to 8pm, seven days a week, to make sure that tenants were safe and well. From this they began delivering ongoing support to 6,500 people: collecting medicines, delivering groceries, distributing food parcels, walking dogs, tidying gardens. As pupils were not at school, school meals staff began cooking and delivering meals to all of the council’s sheltered housing tenants.

Housing departments can meet these challenges most effectively because they can do things on the scale that’s required, combined with the ‘on the ground’ intelligence of housing officers located in communities. Because of the benefits of public ownership, during the lockdown, some councils were able to make use of resources they was saving in some areas and divert these to where they were urgently needed.

Housing associations and Co-operatives have performed a similar role, building upon their wider social remit within communities. Delivering food parcels, cooked meals, packed lunches, groceries and prescriptions for tenants and members, and providing pre-paid energy cards. Some have provided additional sources of support for those experiencing domestic abuse. Others have taken action to ensure people are digitally connected, or have provided online classes.

There couldn’t be a greater contrast with the private rented sector, which houses ever growing numbers of the poorest households. It is entirely ill-equipped, uncoordinated, and lacking in motive to respond to a crisis of this nature. New research by the UK Collaborative Centre for Housing Evidence supports all of this. It has looked at the social, economic, health and wellbeing impact of social housing and found that:

- Social housing and its lower rents appears to help explain Scotland’s better record on poverty compared with the rest of the UK;

- Social housing investment helps make rural communities more resilient, by providing low cost homes for younger people, so they can remain in the area, helping sustain vital public services and employment.

- Well designed social housing investment can contribute to reducing the fundamental causes of health inequalities. An estimated 53,000 more affordable homes are needed between 2021-26. We must ramp up the pressure for current levels of government funding for social house building to be continued, and for the target of 35,000 social homes for 2021 (which has suffered a set back because of the pandemic) to be achieved. There are few better ways to generate economic activity than building homes.

To sum up, the Covid crisis has underscored exactly why we must shift the balance back towards social housing. It has demonstrated the social value of councils, housing associations and housing cooperatives as ‘anchor’ organisations in our communities. They are a source of social resilience in a time of public health crisis, and also the key to building our way out of the current economic crisis.

Monday 6 April 2020

Cleaners on the frontline - Coronavirus

They don’t usually get much thought or

attention – but there isn’t a single list of essential workers doing the

rounds that doesn’t include cleaners. Suddenly they find themselves on the

front line of the worst disease outbreak in a century.

Their task, always vital, has taken on whole new levels of urgency

in recent weeks, often in challenging circumstances. UNISON members report a

wide variety of challenges that cleaners and domestics are dealing with, during the Coronavirus crisis in order that

hospitals and care facilities can continue to function.

The struggle to keep places clean has intensified. Many places are

now working flat out 24/7 – and rotas are having to be shifted to take account

of that. More shifts and less rest are being demanded. Added to that is that

the cleaners, like everyone else have families, have health conditions and can

also catch the virus – so the numbers available for work are down as people

self isolate, meaning this greater workload is being handled by fewer people. Some

authorities are engaged in an effort to recruit and get more cleaners into the

workplace – this is welcome and these efforts need to be stepped up.

It’s not just the workload of course – it’s the fear. A natural worry about being exposed to the

virus is hugely increased by lack of information. Some have not been

told when they have gone into rooms of patients with suspected CV. While changes and developments are made clear to medical staff – its often the case

that these aren’t explained to the cleaners.

In

addition to this, particularly in larger facilities, cleaners are finding

themselves deployed not in their usual areas – but anywhere they are needed. This in an environment where CV patients are

being treated in many different places in the hospital. This is a particular

issue at night where they will find themselves being bleeped to go anywhere in

the building. They worry they are going into

places which are high risk, but which they haven’t been told about.

We were told by one member – who, like many cleaners, has two

jobs. One of these jobs is in an environment much more concerned with treating

virus patients than the other. She prefers going into the more virus facing job

than the other because she is kept up to speed with what is happening there.

Cleaners – by definition , aren’t working at home. They need to

travel to work just like other essential workers. Some, particularly outside

the bigger cities are impacted on by the lockdown. Cleaners are low-paid

workers and many are completely reliant on public transport. As bus services

have been cut back there are many instances of this, mostly female, workforce

finding that the early bus bringing them to work, or the late bus taking them

home, are no longer running. Making an already difficult situation worse.

Without cleaners – none of the institutions and facilities we are

relying on to contain the virus and keep the infected alive could function.

They deserve respect, resources and reward – they are the front line.

Monday 12 August 2019

Pay in Working Class Jobs

Millions of employees in lower and middle income jobs have had real pay reductions over the last ten years.

While the lowest earners, that is those below £9.55 per hour (less than 75% of median pay) have seen a 5% pay increase since 2010 low to middle earners have experienced a 1% pay cut, Low to middle pay is defined as 75%-100% of median pay: £9.56 to £12.73 per hour.

While the lowest earners, that is those below £9.55 per hour (less than 75% of median pay) have seen a 5% pay increase since 2010 low to middle earners have experienced a 1% pay cut, Low to middle pay is defined as 75%-100% of median pay: £9.56 to £12.73 per hour.

The TUC has analysed occupational hourly pay. This work shows that, while changes to the minimum wage have helped the lowest paid, millions of other workers have experienced a real pay cut since 2010.

The TUC is undertaking a series of analyses looking at class in Britain to support the trade union movement's work to advance "the general interests of the working classes.". The reports will look define class through occupation and pay. Going forward they will also look at the experience of class inside and outside or work including "issues of status and respect, control and voice.

This first report focuses on pay and should support the work of trade unions to build a new deal for working people.

Findings

While the lowest earners, that is those below £9.55 per hour (less than 75% of median pay) have seen a 5% pay increase since 2010 low to middle earners have experienced a 1% pay cut, Low to middle pay is defined as 75%-100% of median pay: £9.56 to £12.73 per hour.

While the lowest earners, that is those below £9.55 per hour (less than 75% of median pay) have seen a 5% pay increase since 2010 low to middle earners have experienced a 1% pay cut, Low to middle pay is defined as 75%-100% of median pay: £9.56 to £12.73 per hour.

In the previous decade lowest earners experienced a 10% pay rise and low to middle earners a 7% rise. The minimum wage has made a big difference to the lowest paid but the TUC report shows that without strong trade unions it has been difficult to ensure that improved pay is more widely shared among those stile earning below the median.

Those earning £26 per hour or more have seen their pay increase by 4%.

The biggest groups of those earning below the median rate now work in care and retail. Women and black and minority ethnic workers are over represented in the worst paid jobs and are underrepresented in the higher paid groups.

The New Deal

• The rate for the job and fair pay for everyone

• New rights so that workers can be protected by a union in every workplace, and when

we use social media, so that nobody has to face their employer alone

• New rights for workers to bargain through our unions for fair pay and conditions across

industries, ending the race to the bottom

• A £10 an hour national minimum wage and an end to discrimination against young

workers

• Workers to be elected onto remuneration committees to help curb greed at the top

• Legal requirements on employers to report on and act to close race, gender and

disability pay gaps

• Support for the genuinely self-employed while calling for a ban on zero hours contracts

and false self-employment

• A right to reasonable notice of your shifts, and payment if your shifts are cancelled

• A move to a shorter working time with no loss of pay, starting with four new bank

holidays a year, and setting an ambition for a four-day week

• A right to positive flexible working from day one of your job, with employers required

to advertise all jobs on that basis

• A decent floor of rights for all workers and the return of protection from unfair

dismissal to millions of working people.

The only way to deliver on these aims is to build strong trade unions.

Wednesday 17 July 2019

Delivering a Just Transition

If we put communities and trade unions at the center of decision making then moving to a green economy can be achieved without the destruction of livelihoods and communities seen in past technological change.

A new report by the TUC based on research by the New Economics Foundation examines how we could manage a fair transition by looking three case studies of industrial change: Bilbao, Eindhoven and Iceland. The report then makes recommendations for how Britain can manage the transition to a green economy while maintaining communities and improving livelihoods.

Findings

Findings

Critical success factors

Recommendations for the UK

A new report by the TUC based on research by the New Economics Foundation examines how we could manage a fair transition by looking three case studies of industrial change: Bilbao, Eindhoven and Iceland. The report then makes recommendations for how Britain can manage the transition to a green economy while maintaining communities and improving livelihoods.

Findings

Findings- Bilbao: strong public participation and local autonomy over policy and finance helped lift the city after a devastating flood and "intertwined social, economic and political crises"

- Eindhoven: public investment and cooperation withing the business sector enabled the city to survive the loss of manufacturing jobs and become a hub for technological innovation particularity in health and social care.

- Iceland: moved through the banking crisis and subsequent economic crisis with impressive income and gender equality by maintaining a commitment to social provision and democratic accountability supported by its strong trade union movement.

Critical success factors

- people feel secure and have a stake in their local areas

- there is a strong social safety net to foster long-term opportunity in an area

- genuine opportunities for participation in decision-making

- proactive, positive interactions between state, unions and businesses

Recommendations for the UK

- setting the development of quality jobs as the test for success of the industrial strategy

- ensuring that plans for industrial strategy or economic development are overseen by a social partnership approach

- allowing unions to bargain with employers to maximise employment standards across sectors

- delivering a national entitlement to skills, to give everyone the confidence to adapt to changing demands

- making an increase in good jobs the clear test for local industrial strategies

- bringing together unions, employers and citizens at local level to develop a clear vision and plan for their area

- using local employment charters to drive the development of good work across regions

- using social value procurement to support high quality employment standards, local labour and supply chains and other community benefits.

By taking positive action to improve lives and created well paid secure jobs we can transform our economy and avoid a climate catastrophe. This will not happen without an active state working at all levels with trade unions and communities. Without this we will repeat the mistakes of past which saw communities devastated by the closure of local industries.

Wednesday 3 July 2019

Fair Pay is the Only Route to High Quality Early Learning and Childcare

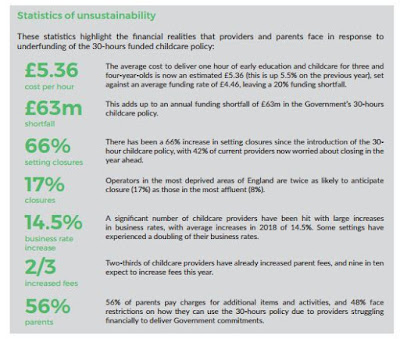

Scotland needs to avoid the mistakes made in England as we move towards increased Early Learning and Childcare hours. Without pay that reflects the skills needed to do the work and appropriate funding the expansion will not work. And we know which children will suffer most from shortages of spaces.

A new report by the All Party Parliamentary Group for

Childcare and Early Education highlights a range of problems in England not

least of which is the fact that the better-off have benefit much more than

those on lower incomes.

The system sees the expansion take place outside the public

sector which has led to an expansion in wealthier areas where parent can afford

to pay to top up the funding for the “free hours”. The research indicates that

17% of providers in deprived areas “anticipate closure in the next 12 months”

compared to only 8% in affluent areas.

This means that it is increasingly difficult for those in

less affluent areas to find a place for their child even if they could afford

the top up fees and extremely difficult for those who only want the “free hours”.

The reality is that outsourcing childcare is not going to save money or build a high quality service

More significantly, for us in UNISON, the report highlights the effects low pay creating difficulties retaining staff in the sector. The early years workforce is highly skilled but poorly paid. Even the

promise of the Scottish Living wage, which is well below public sector pay

rates, will not be enough to recruit and retain staff when other jobs offer the same pay but without the high levels of responsibility,

stress and ongoing professional development required.

In England the average hourly pay was £8.20 an hour: about 40% less than the average female worker. The picture will no doubt be similar here as (outwith the public sector) workers without management roles are generally paid the legal minimum wage for their age.

The Scottish government need 1000s of workers to train up in order to deliverer the promised expansion. Yet they are only promising the Scottish Living Wage to those they are trying to attract. The report shows that low pay is one of the main drivers of childcare workers leaving the sector.

25% of respondents are considering leaving the sector due to stress or mental health difficulties. Heavy workloads, administration and paperwork and the financial resources and of course pay were the top four sources of stress.

Retail jobs are the main competition for staff.The pay is similar and while not an easy job does not have the responsibilities for children's development and health and well-being that early years work includes. It's therefore no surprise that nurseries report difficulties recruiting and retaining qualified staff. Local authorities,also pay substantially better wages and will struggle less to retain staff than the low paying sectors as the expansion goes forward in Scotland. That will be small comfort to parents who cannot get a place for their children in a nursery due to lack of places.

Across the UK governments are attempting to expand childcare. It will not work without the investment to train and to pay the staff a wage that reflects their skills and responsibilities.

Thursday 20 June 2019

It’s never OK

Health workers should be able to get on with their jobs free

from harassment. UNISON’s latest UK wide survey shows that this is not the case.

Following on from the our report showing the violence that Scottish Ambulance Service staff experience at work this UK wide survey indicates that eight per

cent of respondents have suffered sexual harassment in their workplace in the

last two years.

Of those who had experiences harassment 31% said the harassment

was frequent/regular and 12% stated that it occurred daily weekly. The vast

majority (81%) were female. The types of behaviour they describe are:

- Remarks “banter” or “jokes” (64%)

- Invasion of personal space (53%)

- Unwanted or derogatory comments (49%)

- Leering and suggestive gestures (48%)

- Sexual assault including kissing, stroking, touching or hugging (22%)

Respondents also describe how this affects their own behaviour leading to workers:

- Isolating themselves and avoiding certain colleagues/situations

- Wanting to leave/looking for another job

- Poor mental health

- Losing confidence

Sadly while many talked about the harassment with other

colleagues or friends and family 28% keep quiet about it. Only 23% spoke

directly to the perpetrator. Respondents were concerned about formal reporting. Almost

half (49%) felt that “nothing would be done”. Others (37%) were concerned about

being “dismissed as oversensitive”. Almost a quarter (25%) feared retaliation

from the perpetrator and 22% feared that formal reporting could harm their

career. Of those who did report harassment only 15% felt that their

case was handled properly

Quotes from respondents include:

“One of my team ‘upskirted’ a colleague, then sent the video

recording to another member in

the team by ‘accident’.”

“A colleague touched my groin during handovers to ‘show’

where a patient had pain. The

same person also touched around my side to ‘search’ for keys

that I had in my pocket.”

“I work in a control centre and regularly get sexually based

comments from patients.”

“While I was on placement a patient attempted to take my

tunic off, but none of the staff on

the ward did anything.”

“I left the organisation. The nurse who made me feel

uncomfortable made things awkward

and I hated working on the same days as her.”

“I suffered with severe anxiety, and couldn't be left alone

at work. This went on for 12

months even though reported it to a manager.”

“As a result of my experience, I am now more wary about

treating patients that are

intoxicated or under the influence.”

“It was an incident that spooked me. I now purposely wear a

larger uniform and feel myself

tense up if we're called to the area where the patient

lives.”

“It makes me feel nervous and panicked every time I see that

member of staff.”

Joining a trade union will ensure that individuals are

supported if they experience harassment but employers need to be proactive. The government can also drive improvement through reforms

including:

• Reinstatement of section 40 of the Equality Act which

ensured staff were safeguarded against harassment by third parties (for

example, patients and their friends or relatives). Under this clause, employers

were liable if they failed to act after two incidents. However, the government

scrapped this ‘three-strikes’ rule in October

2013 on the grounds that other laws gave staff similar

protection, a claim disputed by UNISON

• The creation by the NHS of a ‘gold standard’ complaints

procedure that's robust and gives workers confidence that their case will be

properly considered. Having good complaints procedures will increase the number

of staff who report an issue and will create an expectation that complaints

will be taken seriously

Wednesday 5 June 2019

Audit Scotland’s accountancy speak can’t hide the increasing strain in further education.

Their latest report states that colleges are “operating within and increasingly tight financial environment”. The sector wide position is challenging but viewing it from that perspective is also masking the sever challenges in some colleges. Twelve colleges are predicting a recurring financial deficits by 2022-23.

While the government can claim to have given colleges some extra cash, this was funding to cover the additional costs of harmonising pay and conditions across the sector following the recent reorganisation of the sector. This does not cover cost of living increases for staff or the extra employer pension costs.

There are also shortages in the capital budget compared to the estimated maintenance costs and the proportion of non-government income generated by colleges is reducing.

The sector continues to change with increasing student numbers. Colleges are changing focus with more learning being provided for over 25s and less for those aged 16-24. The proportion of learning delivered to those from deprived areas has begun to fall after several years on increasing.

While there is considerable variation across colleges for attainment and retention and those going on to so-called positive destinations. Average rates have been relatively static. The attainment rate of 66% for full-time students is still well below the Scottish Funding Council (SFC) target of 75% by 20-21. There is still an attainment gap for students from the most deprived backgrounds and those with disabilities or who are care experienced.

Audit Scotland is calling on colleges to “underlying financial position with the SFC prior to publishing their accounts and improve data collection round student satisfaction as well as publishing that data. They also call on the government to agree a medium term capital investment strategy for ten sector and review college targets in the light of current trends.

Most importantly they call on government and colleges to work together to deliver performance improvement and therefore meet agreed targets.

Subscribe to:

Posts (Atom)